ARAG Group Doubles Net Income

Published on 16/05/24

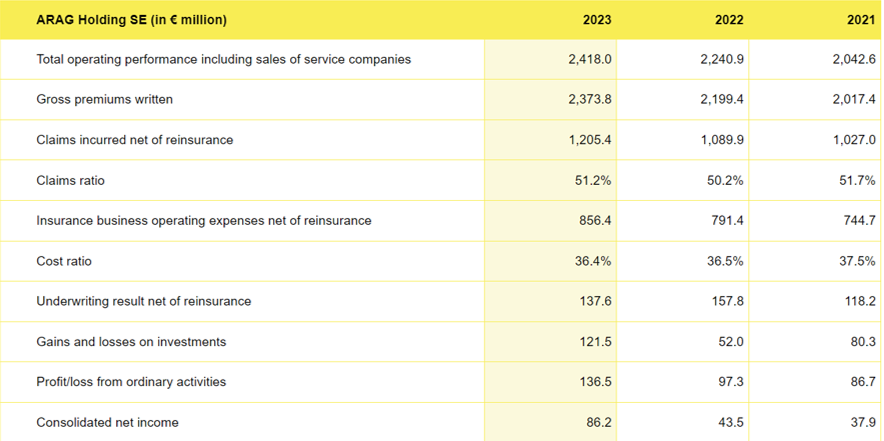

The ARAG Group again increased its gross premium income strongly in 2023 – by 7.9 percent (€174 million) to €2.37 billion. Including sales of service companies, total revenues amounted to over €2.4 billion. The underwriting result of €138 million is the second strongest in the Group’s history. Profit from ordinary business activities increased by 40 percent to €137 million and net profit doubled compared to the previous year to reach €86 million.

“All in all, ARAG was once again in very good shape in 2023. Our capable team, our clear focus on legal and health insurance, and our extensive international diversification, combined with a modern product portfolio and well-established processes, create a resilient recipe for success,” explained Dr. Renko Dirksen, Speaker of the Management Board of ARAG SE, at the presentation of the ARAG Group’s financial statements.

In the German market, strong demand for legal and health insurance continued to drive the ARAG Group’s business. Premium revenues rose by 10.5 percent to €1.4 billion. The international units generated premiums of € 946 million, an increase of 4.3 percent. At the end of 2023, the Group had a total of over 12 million policies in its portfolio.

At Group level, the combined ratio remained at a very good level of 87.6 percent. Due to the strong growth, claims incurred net of reinsurance increased from €1.1 billion to €1.2 billion, while the Group claims ratio rose from 50.2 percent to 51.2 percent. At 36.4 percent, however, the cost ratio was slightly below the previous year's figure of 36.5 percent. Due to the overall positive development on the markets, the Group reported a well-recovered investment result of € 121.5 million (previous year: €52 million) and had hidden reserves of € 216.5 million.

The continued high premium growth is primarily due to the strong legal insurance segment – the largest unit in the Group. This delivered growth of 5.3 percent to € 1.41 billion. The health insurance segment also contributed a strong growth impulse with an increase of 16.8 percent to € 638 million in premium income. The composite segment increased its premium income by 3.5 percent to € 319 million.

Another promising start to the financial year in 2024

The Group’s dynamic development in recent years has continued in 2024. Total premiums and sales revenues in the first quarter increased strongly by 12.3 percent to € 800 million (same period of the previous year: €712 million). Business in Germany grew by 11.7 percent. The health insurance business showed no signs of fatigue with growth of 16.3 percent. The German legal insurance business is also doing well, with growth of 9 percent.

International business, too, has grown significantly – by 13.4 percent. The premium income of DAS UK is included in the international business for the first time in 2024. The ARAG Group expects the full acquisition of the UK legal insurance business from ERGO to generate more than €150 million in additional premium income. In the ongoing post-merger integration, the business of ARAG plc and DAS Holding Ltd. will be gradually merged.

“The ARAG Group remains on course. Business is running at full speed. Business development is already being noticeably shaped by our ARAG 5 to 30 program for the future. Here, too, we are acting, performing and delivering,” emphasized Dr. Renko Dirksen. The company is not counting on organic growth only. ARAG will also consistently take advantage of external growth opportunities as they arise. “We are convinced that the future does not just happen. It is the result of hard work. We are happy to take on the associated efforts for the benefit and advantage of our more than 12 million customers,” said the Speaker of the Management Board.

Disclaimer - all information in this article was correct at time of publishing.